Your path to control and self-determination

So far in this series we talked about the process of starting a company, how to structure and share your work with others, and how to find customers. Now we come to the part where we talk about the source of power: self-employment, and financial management and budgeting. I know many people tend to feel a little dismissive of that hassle of money, but believe me, it's worth embracing it wholeheartedly. This is where you have the control functions and power over your workday. Control your finances instead of letting it control you. It will be so much easier and so much more fun!

There are many words that are unfamiliar to those of us who are not economists. We have not acquired the technical language and it is easy to miss out on important details. But as a freelancer or entrepreneur, to run your own company, you don’t need to be an economist. This is why in this episode we will go through the basic tools that you need to have to gain a good understanding and control of your finances and company.

Budgeting

Let's start with the framework: your budget. The first budget made in a company is often the start-up capital budget and a first profit budget. As a first definition, budgeting refers to writing down in advance the expected numbers for an event or period in your business. You can do this in ready-made templates (in Sweden you can use the templates from Almi or in Nyföretagarcentrum's business plan, which can be downloaded free of charge from the respective website), or you can write on a napkin. The form is not the important thing here. The content is what truly matters.

Now, with all that being said, in the beginning it might nonetheless be wise to use a template. This will give you some guidance, as well as offer you more credibility in case you apply for a loan or funding. Bear in mind though, that many details of what a budget needs to include is still up to you to figure out yourself. This is where you will exercise your freelancer or entrepreneur analytical skills and creativity.

Start-up capital budget

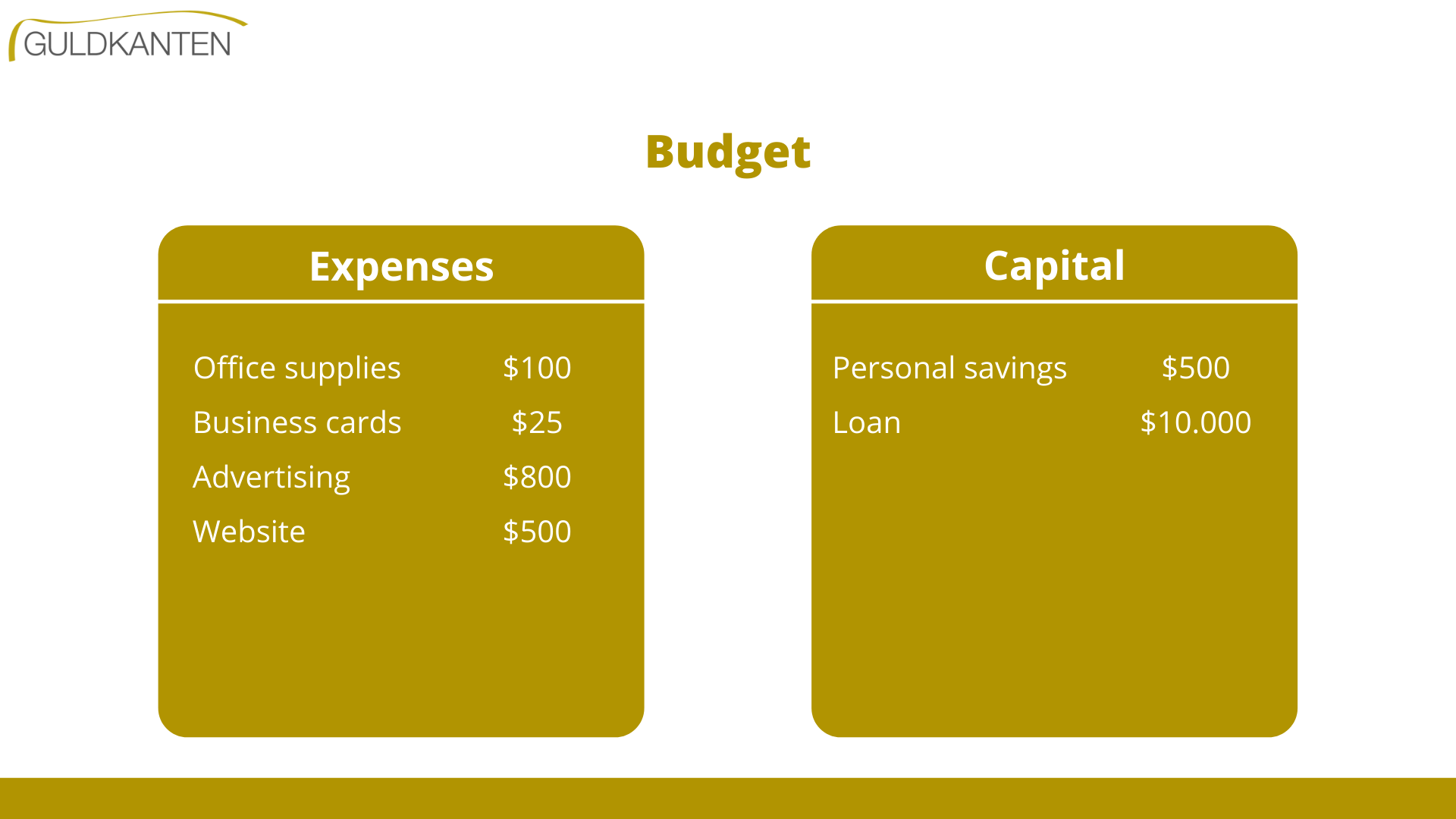

The start-up capital budget is written in the early stages, when you plan to open your company. In simple terms, a start-up capital budget is an enumeration of the costs incurred by starting up the company, together with a description of where that money will come from.

Visually it can look similar to two columns with numbers: expenses and available funds (including loans you may need to obtain to get started). To be able to start, the assets must be equal to or greater than the expenses. You probably recognize this principle - not at all more complex than simple household finances.

Budgeting for new ideas

When you are running your business and want to make new investments, you make a similar setup for this particular idea, an investment budget. In the same way, you write down all the costs associated with building this new product and then you look at what resources you have. Are they enough or do you need to borrow/save? This is the mindset that you as a freelancer or entrepreneur need to adopt to make wise decisions about new ideas.

Performance budget

To then assess whether this is a good idea, you also need a performance budget. In the profit budget, you write down your expected sales and under it all the minus items - meaning all the costs you can see that the company will have during that same period. The usual time frame for this is one year.

Start by making as accurate an estimate as possible of how much you realistically think you will actually be able to sell, the market contact you have, and the number of hours you have at your disposal. Sometimes it's nice to budget for two years: in the first year you will probably still work on getting clients, and then the second year will reflect how your by-then already setup business will run. Other entrepreneurs and freelancers work with alternative scenarios: a pessimistic, a probable, and a successful budget - you can try this as well.

Adjust your expectations about time

Never count on doing 40 hours a week of salesperson/marketing/performance work. It takes time to run a business. You have to take care of administration, market yourself, network, further train yourself, clean the office and so on. As a freelancer or entrepreneur you cannot put all your time into selling your product.

Think about costs

After you figured out what your expected turnover is, it’s time to look at the expected costs - from small to large. Try to include everything from paper clips to monthly rents. The clearer you are at this stage, the more accurate your budget will be. Budget templates come in handy here because they list the most common expenses a company has. Those suggestions will be a good starting point.

Calculating the profit

From then on it's simple math. Income minus expenses gives you a total. This will be the profit on your work. If you have a sole proprietorship, a simple rule of thumb in Sweden is that half here goes to you, half to the tax office. If you have a joint-stock company, you should also count in the salary and employer's contribution among the costs; any surplus from there is the company's profit. Check the laws and taxes in the country where you are running your company to make sure your calculations match.

Performance budget

Use your expected profit to create a performance budget.The performance budget refers to predictions you make about what you can/cannot afford in the future based on your expected profit. For example: “If my profit will be $10.000, I will be able to invest half of that into developing a new product and the rest of the money I will divide between marketing and savings. However, if my profit will be $5000, my salary will shrink by 10% and I will invest the profit into marketing.”

During the year, you should regularly check on your budget and make budget adjustments. Put your plan side by side with your actual balance sheet and see how close to the truth you came up with your guesses. Maybe you are selling more than expected. Then you can think about whether you want to invest in new office gadgets, developing a new product, or taking a higher salary. If you sell less than expected, the earlier you realize this, the easier it will be to decide what to do and how to cope with that: increase the marketing efforts, or reduce some costs?

You are the one at the helm of your company. The budget and budget adjustments help you predict the future and make conscious proactive decisions instead of being reactive. Budgeting gives you the opportunity to choose, based on your context and resources, how and when to invest and see what is required for you to be able to afford to do what you want.

Set time aside for an annual budget

At least once a year you should sit down and make a new annual budget. As the years go by, it will go faster and faster. Then you can probably copy over last year's figures and then focus on what you want to change. But take your time and do the job. Should sales be at the same level? Have you lost or gained a large customer who can be expected to bring your numbers to the next level?

If you invest in education and set aside time for a longer education process, the income will probably fall that year, you will not have time for as many customers, while the expenses will increase for travel, literature and course fees. What happens to your salary then? Is it worth it? Take the time to think about these issues. Choose where you want to invest your money this year and write your budget like that.

You decide. Then it's also up to you to deliver. The fun of budget work in working as a freelancer or entrepreneur is the direct feedback it gives on your own efforts.

In the next part of this episode on financial management and budgeting we talk about working with key figures.